Delving into the realm of Business General Liability Insurance in 2025 opens up a world of evolving trends and crucial changes that companies need to navigate. As we explore the intricacies of this insurance sector, we uncover the vital role it plays in safeguarding businesses and adapting to the dynamic landscape of the future.

Detailing the historical significance and contemporary relevance, this overview sets the stage for a comprehensive understanding of the topic at hand.

Overview of Business General Liability Insurance in 2025

Business general liability insurance has a long history dating back to the early 20th century when companies started recognizing the need to protect themselves from potential lawsuits and financial losses. This type of insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims.

Business general liability insurance is crucial for companies as it helps protect them from costly legal expenses, medical bills, and damages that may arise from accidents or negligence. It gives businesses a safety net to operate without the constant fear of being sued or facing financial ruin due to unforeseen circumstances.

Key Changes and Trends in Business General Liability Insurance by 2025

- Increased Cyber Liability Coverage: With the rise of cyber threats and data breaches, business general liability insurance policies in 2025 are expected to include more comprehensive coverage for cyber liability. Companies will need to protect themselves from cyber-related risks, including data breaches, hacking, and ransomware attacks.

- Customized Coverage Options: In 2025, insurers are likely to offer more tailored coverage options to meet the specific needs of different industries and businesses. This customization will allow companies to choose coverage that is relevant to their operations and potential risks.

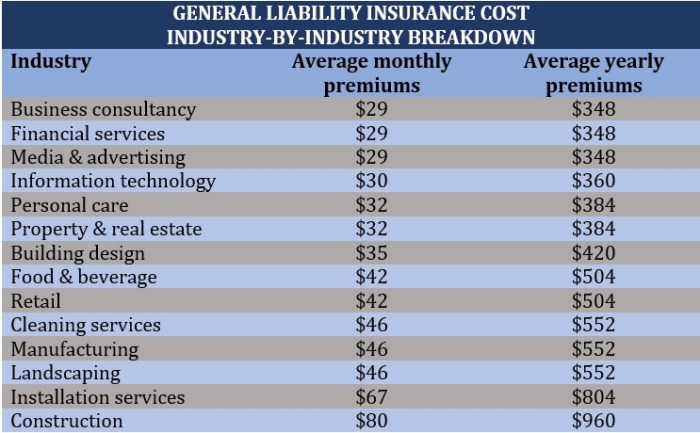

- Rising Premiums: Due to the increasing number of lawsuits and high-dollar settlements, business general liability insurance premiums are expected to rise in 2025. Companies will need to budget accordingly to ensure they have adequate coverage without breaking the bank.

- Focus on Risk Management: Insurers in 2025 will place a greater emphasis on risk management strategies to help companies prevent claims and mitigate potential losses. This proactive approach will not only benefit the insurers but also help businesses operate more safely and efficiently.

Types of Coverage Offered

Business general liability insurance typically includes several types of coverage to protect businesses from various risks and liabilities. Let's explore the different types of coverage options available in 2025 and compare them with those from previous years.

General Liability Coverage

General liability coverage protects businesses from third-party claims of bodily injury, property damage, or advertising injury. This coverage is crucial for businesses that interact with clients, customers, or visitors on their premises.

Product Liability Coverage

Product liability coverage is essential for businesses that manufacture, distribute, or sell products. It protects against claims related to injuries or damages caused by products sold or supplied by the business.

Professional Liability Coverage

Professional liability coverage, also known as errors and omissions (E&O) insurance, is vital for businesses that provide services or professional advice. It protects against claims of negligence, errors, or omissions in the services provided.

Cyber Liability Coverage

Cyber liability coverage helps businesses mitigate the financial losses associated with data breaches, cyber-attacks, or other cybercrimes. With the increasing reliance on digital data and technology, this coverage has become crucial for businesses in 2025.

Employment Practices Liability Coverage

Employment practices liability coverage protects businesses from claims related to wrongful termination, discrimination, harassment, or other employment-related issues. In today's evolving work environment, this coverage is essential to safeguard businesses from legal disputes with employees.

Commercial Property Coverage

Commercial property coverage protects businesses from losses related to damage or destruction of their physical assets, such as buildings, equipment, inventory, and furniture. This coverage is crucial for businesses that own or lease commercial property.Each type of coverage plays a crucial role in safeguarding businesses from different risks and liabilities in today's dynamic business landscape.

Emerging Technologies Impacting Business General Liability Insurance

In today's fast-paced digital age, emerging technologies are revolutionizing the insurance industry, including business general liability insurance. These advancements are reshaping the landscape of insurance practices, offering both benefits and challenges for insurers and policyholders alike.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are playing a significant role in transforming business general liability insurance. Insurers are leveraging AI algorithms to analyze vast amounts of data quickly and accurately, improving risk assessment and underwriting processes. Machine learning models can predict trends and potential risks, enabling insurers to make more informed decisions and tailor coverage to individual businesses.

- AI-powered chatbots are enhancing customer service by providing instant responses to policyholders' inquiries and claims submissions.

- Machine learning algorithms are helping insurers detect fraudulent claims efficiently, reducing costs and improving overall operational efficiency.

- Predictive analytics tools are being used to forecast future claim trends, allowing insurers to proactively mitigate risks and adjust coverage accordingly.

Blockchain Technology

Blockchain technology is revolutionizing the way insurance transactions are conducted, providing a secure and transparent digital ledger for policy management and claims processing. By utilizing blockchain, insurers can streamline processes, reduce fraud, and enhance data security for both insurers and policyholders.

- Smart contracts on blockchain platforms allow for automated claims processing based on predefined conditions, improving efficiency and reducing processing times.

- Blockchain's decentralized nature enhances data security and transparency, reducing the risk of data breaches and ensuring the integrity of insurance transactions.

- By creating a tamper-proof record of policyholder information and claims history, blockchain technology can simplify auditing processes and improve compliance with regulatory requirements.

Regulatory Changes and Compliance Requirements

In the lead-up to 2025, the insurance sector has seen significant regulatory changes aimed at enhancing transparency, consumer protection, and overall industry stability. These changes have directly impacted the landscape of business general liability insurance, influencing how businesses operate and fulfill their compliance obligations.

Regulatory Changes in the Insurance Sector

- Increased regulatory oversight by government agencies to ensure fair practices and prevent fraud in insurance transactions.

- Implementation of stricter guidelines for insurance companies to maintain adequate reserves to cover potential liabilities.

- Introduction of new laws and regulations to address emerging risks such as cyber threats and climate change impacts on businesses.

Compliance Requirements for Businesses

- Businesses are required to accurately disclose their operations and risks to insurance providers to obtain appropriate coverage.

- Regular premium payments and timely renewal of policies are essential to maintain continuous coverage and comply with regulatory standards.

- Adherence to safety standards and risk management practices to minimize the likelihood of claims and demonstrate proactive risk mitigation efforts.

Implications of Non-Compliance

- Businesses that fail to comply with regulatory requirements may face penalties, fines, or even suspension of operations.

- Non-compliance can lead to gaps in insurance coverage, leaving businesses vulnerable to financial losses in the event of a liability claim.

- Lack of compliance with regulatory changes can damage a company's reputation and erode trust with stakeholders, impacting long-term sustainability.

Customization and Tailored Policies

In the evolving landscape of business general liability insurance in 2025, there is a noticeable shift towards more customized and tailored insurance policies for businesses. This trend reflects the need for personalized solutions to meet the unique needs and risks of different industries and businesses.

Examples of Industries Benefitting from Personalized Insurance Solutions

- Technology Startups: Technology companies often have specific risks related to data breaches, intellectual property, and product liability. Tailored policies can address these unique concerns.

- Construction Companies: Construction firms face risks such as bodily injury, property damage, and subcontractor liability. Customized insurance solutions can provide coverage for these specific risks.

- Retailers: Retail businesses may require coverage for slip-and-fall accidents, product liability claims, and cyber threats. Tailored policies can help protect retailers against these risks.

Advantages and Potential Drawbacks of Tailored Policies in General Liability Insurance

- Advantages:

- Increased Coverage: Tailored policies can provide comprehensive coverage for specific risks that may not be addressed by standard insurance plans.

- Cost-Effectiveness: Businesses can optimize their insurance spending by only paying for the coverage they need, reducing unnecessary expenses.

- Improved Risk Management: Customized policies allow businesses to focus on their unique risks and implement risk management strategies accordingly.

- Potential Drawbacks:

- Complexity: Tailored policies can be more complex to understand and manage, requiring businesses to invest time in reviewing and analyzing their insurance coverage.

- Coverage Gaps: If not properly structured, customized policies may leave businesses vulnerable to certain risks that are not adequately covered.

- Cost Variation: Customized policies may result in fluctuating costs based on the specific coverage needs of the business, making budgeting more challenging.

Ending Remarks

Summarizing the complexities and advancements discussed, A Breakdown of Business General Liability Insurance in 2025 encapsulates the essence of preparedness and adaptability that companies must embrace for a secure future.

User Queries

What are the key changes in business general liability insurance by 2025?

The key changes include a shift towards more customized policies, the influence of emerging technologies, and stricter compliance requirements to adapt to the evolving business landscape.

How do businesses benefit from personalized insurance solutions?

Businesses benefit from tailored policies by gaining coverage specific to their industry risks, thereby ensuring comprehensive protection against potential liabilities.

What are the implications of non-compliance with regulatory changes in general liability insurance?

Non-compliance can lead to fines, legal repercussions, and gaps in coverage that leave businesses vulnerable to financial risks and lawsuits.